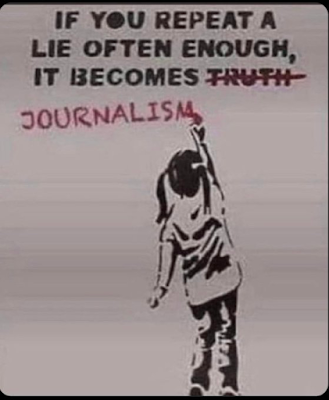

This is a great example of how the mainstream media spreads the most fake news

— Dom Translator 🇺🇦 (@dom_translator) October 4, 2022

This is a total lie, but the Guardian doesn't care. It just wants to make money off its readers

The same media told these people that the CIA is certain Hunter Bidens laptop is Russian disinformation pic.twitter.com/hencqtUHKC

Actual spend by the Bank is currently less than £4BN.

Tax Investigation InsuranceHere's a simple chart to show that the #BankofEngland has not, in fact, had to spend "£65 billion" to prop up the #gilts market (and almost certainly won't, either)... 🤓

— Julian Jessop (@julianHjessop) October 4, 2022

You can find the data here: https://t.co/GmtZHhEVGz pic.twitter.com/48ekprMC5B

Market leading tax fee protection insurance for businesses, sole traders and individuals. Protect yourself from accountancy fees in the event of an HMRC enquiry.

Having a Solar Protect Tax Investigation Insurance policy at your disposal means that should you be one of the many 1000's of businesses or individuals that are selected by HMRC each year to look into your tax affairs your own accountant (your tax return agent) can get on and defend you robustly.

You have the peace of mind knowing that your accountant's (your tax return agent) fees will be paid by the insurance without any Excess for you to find.

Tax Investigation Insurance is an insurance policy that will fully reimburse your accountant's (your tax return agent) fees up to £100,000 if you are subject to enquiry by or dispute with HMRC.

A Solar Protect policy will enable your accountant (your tax return agent) to:

- Deal with any correspondence from HMRC

- Attend any meeting with HMRC

- Appeal to the First-tier Tribunal or Upper Tribunal

- Having the security of knowing that fees will be met in full will enable your Accountant (your tax return agent) to defend your position robustly

Please click here for details.

No comments:

Post a Comment