Inflation Data Overview: Today's inflation data revealed a rise to 2.3% in October, surpassing the forecasted 2.2%. This marks a significant increase from the previous month's 1.7%. The rise was primarily driven by higher energy bills, with household gas and electricity costs increasing due to the energy price cap.

Comparison to Previous Month and Expectations:

Previous Month: September's inflation rate stood at 1.7%, indicating a substantial month-on-month increase.

Expectations: Economists had predicted a 2.2% rate, making today's figure a slight but notable overshoot.

Main Reasons for the Increase: Higher energy bills were a significant driver. The energy price cap led to increased household gas and electricity costs. Additionally, core inflation, which excludes volatile food and energy prices, rose to 3.3%, higher than the expected 3.1%. Services inflation also increased to 5%, above the previous month's rate and forecasts.

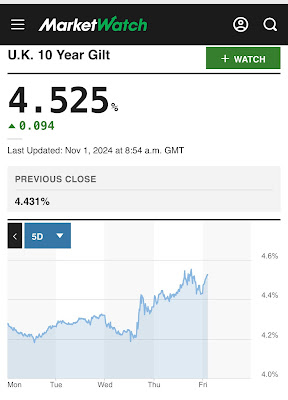

Likely Impact on Interest Rates: The higher-than-expected inflation data reduces the likelihood of an interest rate cut by the Bank of England in December. Before the data release, there was a 21.7% chance of a 0.25 percentage point cut, which has now decreased to 84% chance of no cut. The Bank of England is expected to maintain a cautious approach, potentially keeping rates unchanged at 4.75%.

Effect of Rachel Reeves' Budget on Future Inflation Figures: Labour's recent budget, which includes increases in employers' national insurance contributions, is expected to inject a significant fiscal stimulus into the economy. This could lead to higher prices and potentially slow the pace of interest rate cuts. The budget's impact on inflation forecasts is likely to be substantial, with concerns that it may push inflation higher in the coming months.

In summary, today's inflation data indicates a notable increase driven by energy costs and core inflation. The Bank of England is likely to maintain a cautious stance on interest rates, and Labour's budget could further influence future inflation figures.

In short this, coupled with the appalling growht figures, means we are entering a period of stagflation.

Tax Investigation Insurance

Market leading tax fee protection insurance for businesses, sole traders and individuals. Protect yourself from accountancy fees in the event of an HMRC enquiry.

Having a Solar Protect Tax Investigation Insurance policy at your disposal means that should you be one of the many 1000's of businesses or individuals that are selected by HMRC each year to look into your tax affairs your own accountant (your tax return agent) can get on and defend you robustly.

You have the peace of mind knowing that your accountant's (your tax return agent) fees will be paid by the insurance without any Excess for you to find.

Tax Investigation Insurance is an insurance policy that will fully

reimburse your accountant's (your tax return agent) fees up to £100,000

if you are subject to enquiry by or dispute with HMRC.

A Solar Protect policy will enable your accountant (your tax return agent) to:

- Deal with any correspondence from HMRC

- Attend any meeting with HMRC

- Appeal to the First-tier Tribunal or Upper Tribunal

- Having the security of knowing that fees will be met in full will enable your Accountant (your tax return agent) to defend your position robustly

Please click here for details.