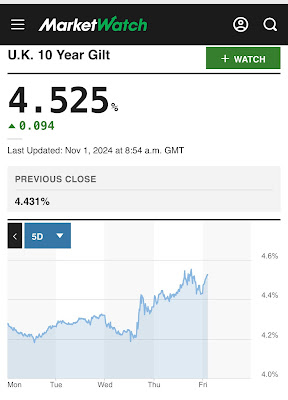

In the wake of the recent budget announcement, UK gilt yields have seen a significant rise. The yield on 10-year UK government bonds has now surged to 4.5%, a notable increase from the previous rate of 4.37%. This rise in gilt yields is a direct result of market reactions to the budget's fiscal policies, which have led to increased borrowing costs.

Why Rising Gilt Yields Lead to Higher Mortgage Costs

Gilt yields and mortgage rates are closely linked. When the government issues bonds (gilts), investors buy them, and the yield is the return they get on their investment. Higher gilt yields mean the government has to pay more to borrow money, and this increased cost is often passed on to consumers in the form of higher interest rates on loans, including mortgages.

Examples of Lenders Pulling Mortgage Deals

Several lenders have already reacted to the rising gilt yields by pulling mortgage deals or increasing rates. For instance, Nationwide Building Society recently withdrew several of its mortgage products, citing the volatile market conditions. Similarly, HSBC and Barclays have also adjusted their mortgage offerings, with some fixed-rate deals being pulled from the market.

Conclusion

The recent rise in gilt yields following the budget announcement is a clear indicator of the market's reaction to increased borrowing costs. This trend is likely to continue, leading to higher mortgage costs for consumers. As lenders pull mortgage deals and adjust their rates, it's crucial for potential homebuyers to stay informed and consider their options carefully.

Tax Investigation Insurance

Market leading tax fee protection insurance for businesses, sole traders and individuals. Protect yourself from accountancy fees in the event of an HMRC enquiry.

Having a Solar Protect Tax Investigation Insurance policy at your disposal means that should you be one of the many 1000's of businesses or individuals that are selected by HMRC each year to look into your tax affairs your own accountant (your tax return agent) can get on and defend you robustly.

You have the peace of mind knowing that your accountant's (your tax return agent) fees will be paid by the insurance without any Excess for you to find.

Tax Investigation Insurance is an insurance policy that will fully

reimburse your accountant's (your tax return agent) fees up to £100,000

if you are subject to enquiry by or dispute with HMRC.

A Solar Protect policy will enable your accountant (your tax return agent) to:

- Deal with any correspondence from HMRC

- Attend any meeting with HMRC

- Appeal to the First-tier Tribunal or Upper Tribunal

- Having the security of knowing that fees will be met in full will enable your Accountant (your tax return agent) to defend your position robustly

Please click here for details.

No comments:

Post a Comment